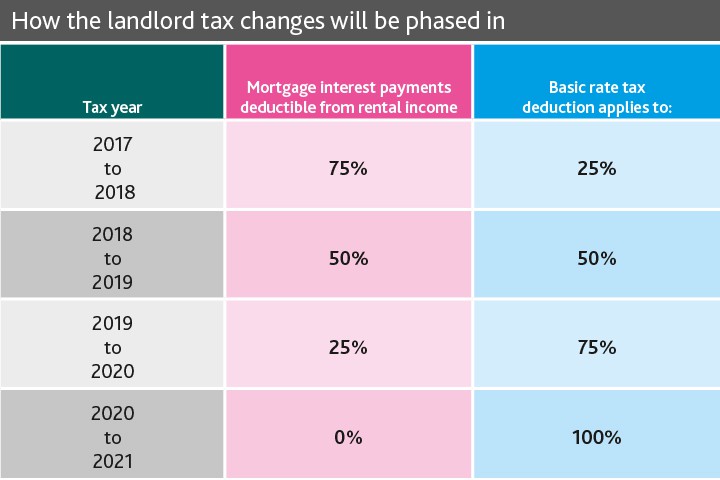

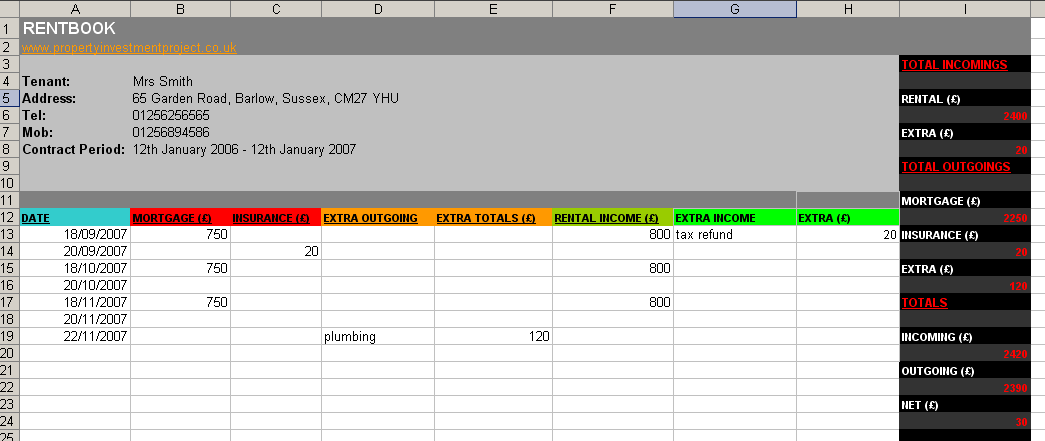

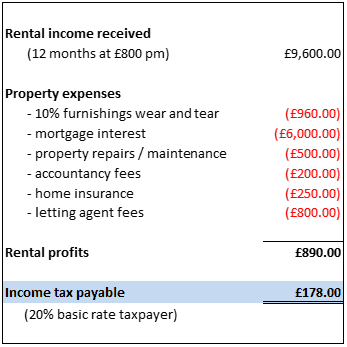

Landlord tax liabilities tax on rental income, tenant tax, property rental and tax return, tax deduction for mortgage interest, who fills the self assessment on rental income from joint property, tax deductible

Number of UK buy-to-let landlords admitting to avoiding tax on rental income rises by 145% in a year | Insights | UHY Hacker Young

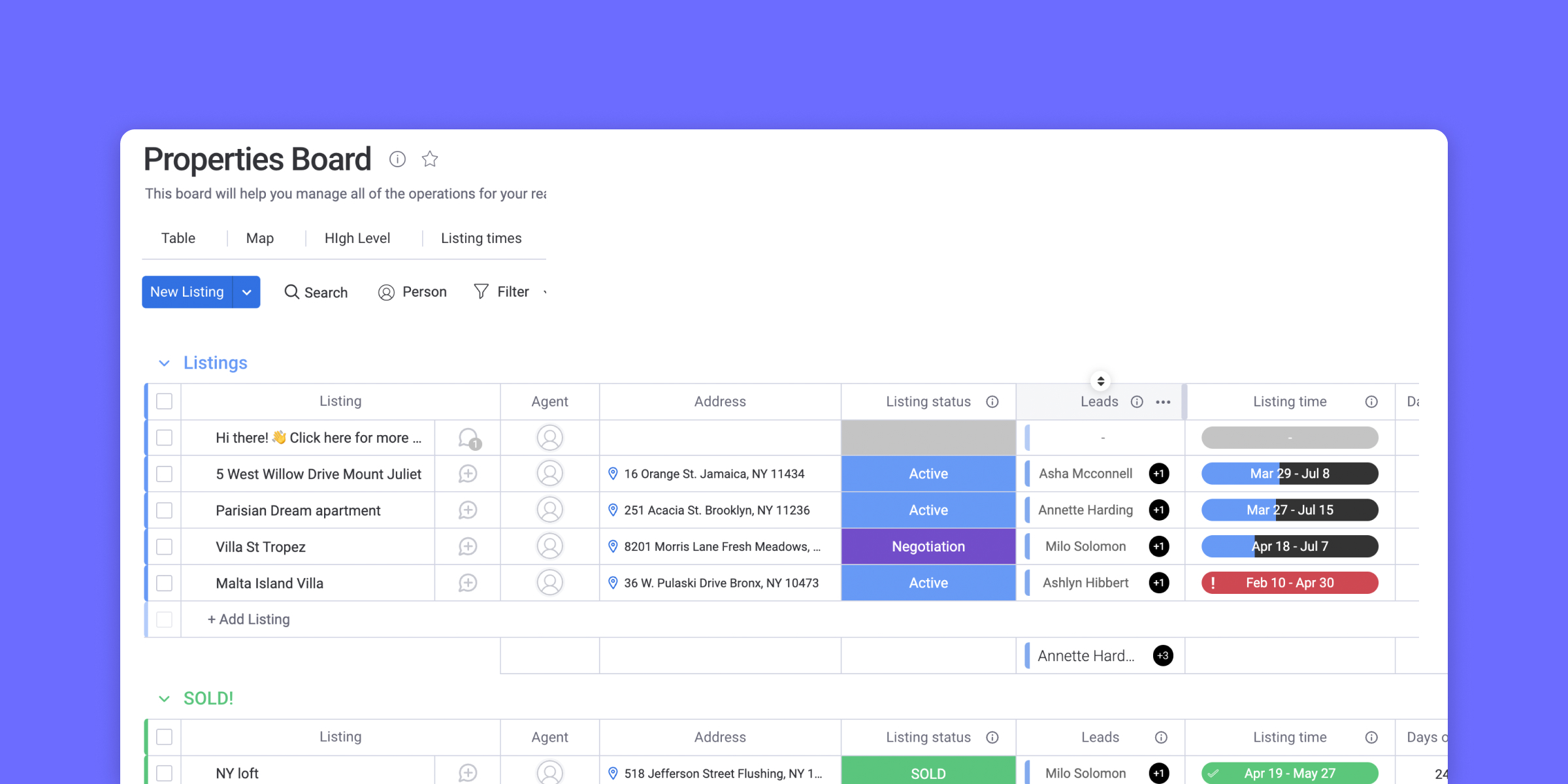

How to Calculate Rental Yield Using Your Property Value, Rental Income and Costs | OpenRent Landlord Hub